Major projects & construction 5 Minute Fix 135: all or nothing, payment claims, email service, Victorian building law reforms

Get your fix of major projects and construction news. In this edition: "all or nothing" approach in defective work claims; compliance with the statutory timeframes for serving payment claims in Queensland; security of payment laws meet the Australian Consumer Law; serving a payment claim by email; significant reforms to Victoria’s building laws get Royal Assent.

When an "all or nothing" approach leaves the claimant with (almost) nothing

A recent NSW Supreme Court decision highlights the risks of pursuing an "all or nothing" approach in defective work claims. In 85 Princess Pty Ltd v Fleming [2025] NSWSC 407, a purchaser sought $5.3 million in damages for the removal and replacement of a defective concrete slab in an industrial building. The purchaser alleged breaches of warranties in the sale contract. While this case arose from a sale contract rather than the usual construction contract, the warranties in question were standard workmanship and materials warranties commonly found in construction contracts.

The Court agreed that the slab was defective, and that the vendor had breached several warranties. However, it awarded only $100 in nominal damages, rejecting the purchaser's claim for full replacement of the slab. Why? The Court determined that full replacement was unreasonable and unnecessary, as the slab could be adequately repaired by filling the cracks and monitoring them. Notably, the purchaser did not engage with the costs of alternative repair methods, prompting Justice Brereton to observe that the parties had run their case on an "all or nothing basis."

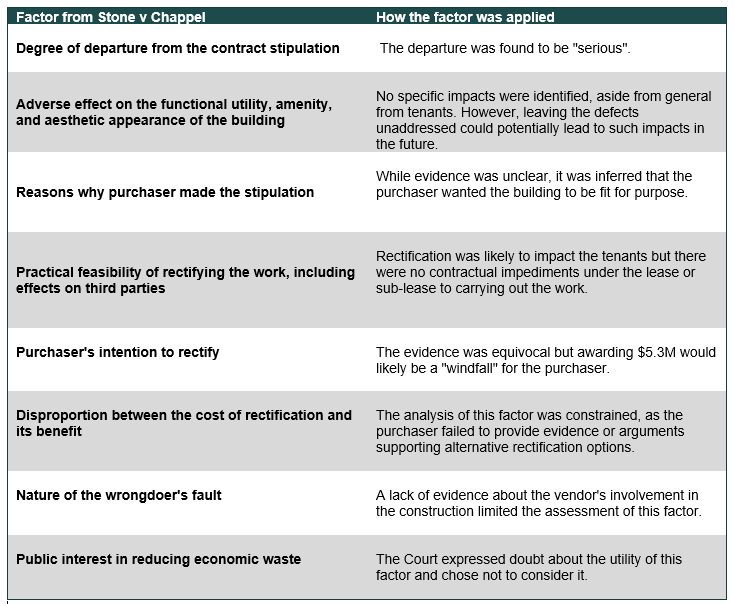

This case marks the first time a Supreme Court outside South Australia has applied the eight factors for assessing the "reasonableness" limb as identified by Chief Justice Kourakis in Stone v Chappel [2017] SASCFC 72. The table below summarises the factors and the way in which they were applied.

Ultimately, the purchaser's "all or nothing" approach proved costly, as it failed to present evidence of the costs of less invasive repair methods. The Court also declined to order specific performance of the warranties, noting that such orders require ongoing supervision, which courts are reluctant to undertake. This case highlights the importance of presenting the court with reasonable rectification options and avoiding disproportionate claims, which could result in minimal recovery.

Compliance with section 75(2)(b) of the BIF Act: A necessary jurisdictional fact for payment claims

The Supreme Court of Queensland has clarified that compliance with the statutory timeframes for serving payment claims under section 75(2)(b) of the Building Industry Fairness (Security of Payment) Act 2017 (BIF Act) is a strict legal requirement, and failure to meet this requirement will invalidate an adjudication decision.

In Forme Two Pty Ltd v McNab Developments (Qld) Pty Ltd [2025] QSC 96, Justice Hindman determined that compliance with section 75(2)(b) is a "jurisdictional fact" necessary for a valid adjudication decision. Section 75(2)(b) requires a payment claim to be served within the longer of:

the period specified in the contract; or

six months after the construction work or related goods and services, to which the payment claim relates, was last carried out.

Justice Hindman found that McNab's non-compliance with this provision rendered the adjudication decision void due to jurisdictional error. Her Honour applied the distinction from Icon Co (NSW) Pty Ltd v Australia Avenue Developments Pty Ltd [2018] NSWCA 33 between "category 1" and "category 2" matters. A category 1 matter requires objective compliance with a statutory requirement, which must be determined by a court. In contrast, a category 2 matter allows an adjudicator to form an opinion in good faith, even if the finding is later found to be incorrect. Her Honour concluded that compliance with outer time limit for interim claims in section 75(2)(b) was an objective jurisdictional fact, and therefore a category 1 matter. Because section 75(2)(b) requires a payment claim to include a claim for payment related to work carried out within the six months prior to the claim being given, and this payment claim did not include any such work, it failed to comply with the statutory requirement.

This decision is significant as it marks the first instance in which a Queensland court has directly considered whether section 75(b)(2) constitutes a "basic and essential statutory requirement."

Victorian Supreme Court confirms SOP Act and ACL enforcement processes coexist, not conflict

The decision in 1559 High Street Pty Ltd v Camillo Builders Pty Ltd & Ors [2025] VSC 244 confirmed that the Building and Construction Industry Security of Payment Act 2002 (Vic) (SOP Act) is not inconsistent with the Australian Consumer Law (ACL). Justice Stynes found that the SOP Act's adjudication and enforcement provisions, which facilitate the "pay now, argue later" framework, were not inconsistent with the ACL, and were therefore not invalid under s109 of the Commonwealth Constitution.

Her Honour emphasised the procedure for enforcing adjudicated amounts under the SOP Act does not "alter, impair or detract from" rights "under the ACL. It merely allows the enforcement of an interim payment before the final determination of the parties' rights. As Justice Stynes observed:

"the ACL creates a regime for the curial enforcement of rights. It does not undermine that scheme to allow a separate and new set of statutory rights to be created, and to leave it to a court to decide whether those rights can be enforced ahead of the ACL claim – especially when considered in the context of the "full judicial armoury" (including case management, interlocutory injunctions, stays, freezing orders and remedial awards such as interest and restitution) – and nothing in the SOP Act carves out this Court's inherent power to grant an injunction or to order a stay in a proper case."

The decision will also be of interest to other East Coast SOP models, which similarly aim to balance the need for expedited interim payments with preserving parties’ substantive legal rights.

When actions speak louder than words: implied consent to email service of payment claims

Determining whether a payment claim served by email is valid under the Building and Construction Industry Security of Payment Act 1999 (NSW) (SOP Act) can be complex. If the recipient has clearly consented to receiving payment claims by email, the process is relatively straightforward. However, complications arise when consent must be implied from the recipient's prior conduct.

In Claire Rewais and Osama Rewais t/as McVitty Grove v BPB Earthmoving Pty Ltd [2025] NSWCA 103, the NSW Court of Appeal clarified when a person is considered to have "specified" an email address for service under s 31(1)(d) of the SOP Act. The Court also considered the types of documents that can be validly served using that email address.

The case involved a payment claim that BPB Earthmoving Pty Ltd (BPB) sent by email on 24 April 2024. However, the claim only came to the attention of the owners, the Rewaises, on 11 June 2024, when BPB's solicitors forwarded the earlier emails to both the Rewaises and their solicitors. The Court of Appeal considered whether the primary judge was correct in finding that the payment claim was not served until 11 June 2024. This finding had significant implications, as it meant BPB's adjudication application was lodged prematurely. Ultimately, the Court of Appeal found that the Rewaises had "impliedly" specified the email address for service of the payment claim and the s 17(2) adjudication notice. This conclusion was based on the Rewaises' prior use of the email address in communications, including for invoices identified as payment claims under the SOP Act, which they had paid without objecting to the method of service. The Court of Appeal confirmed that under Section 13A of the Electronic Transactions Act 2000 (NSW), an email is deemed to be served even if it has not been opened or read by the recipient. This meant the payment claim sent to the Rewaises was validly served irrespective of whether they had accessed the email.

Victorian Parliament passes building law reforms

The Victorian Building Legislation Amendment (Buyer Protections) Act 2025 has received assent, introducing significant reforms to Victoria’s building laws. Designed to protect homebuyers, particularly in residential developments, the changes are set to commence on 1 July 2026, unless proclaimed earlier. The Act passed without major changes from the version of the Bill outlined in our previous update. The Minister has indicated that further detailed regulations are forthcoming, so construction industry stakeholders should remain alert to these developments.

Get in touch