Major Projects & Construction 5 Minute Fix 76: estoppel, security of payment, Lacrosse liability, NSW building reform

Clear language is critical to ending an estoppel

Permitting departures from strict compliance with contractual requirements as to when, how, and in what form notices must be given can give rise to estoppel and waiver, and lead to an inability to rely on non-compliance with those requirements as a reason to reject a claim. A recent NSW Court of Appeal decision (Valmont Interiors Pty Ltd v Giorgio Armani Australia Pty Ltd (No 2) [2021] NSWCA 93) demonstrates this risk and emphasizes the importance of clear and unambiguous communication if a party wants to bring a shared assumption (giving rise to estoppel) to an end.

The key principle was described by the Court in the following terms:

"The duty referred to by Gaudron J in Waltons Stores, namely, to inform a party labouring under a particular assumption that the basis for that assumption had 'materially changed', is one which must be discharged clearly. Unless there is a sufficiently clear communicated correction or a withdrawal of the basis for an assumption which has been made by another party, considerations of conscience may dictate that an estoppel based upon that assumption has continuing effect."

The facts in the case were complex, but Armani was estopped from denying the contractor's entitlement to recover additional money for a joinery variation claim because the contractor had not given Armani prescribed notices. The estoppel arose from an assumption between the parties that strict compliance by the contractor with the prescribed notices procedure was not required.

The primary judge held that, while the estoppel operated for a period, email exchanges displaced this assumption and the estoppel came to an "abrupt halt" after 11 April 2016 when Armani's representative wrote:

"There are no variations on this project. It is a capped off cost which means items cannot be issued under variation and it is a lump sum amount which covers the project. I am happy to discuss this anytime. Please see the original paperwork which secured you the project 11th December.

If you would like to deviate from this original agreement – lets discuss what and why."

The Court of Appeal disagreed. It looked at whether the email exchanges "materially changed" the basis for the assumption and found they did not. President Bell (with whom Justices Macfarlan and Leeming agreed) concluded that, in the context of the preceding exchanges, the email of 11 April 2021 did not relate to joinery, but to other parts of the works and observed:

"The email correspondence of 11 April 2016 did not make it clear to Valmont expressly or by necessary implication that Armani, having instructed Valmont to supply the balance of the joinery which it was Armani’s contractual obligation to supply, no longer intended to pay for that joinery, either because of non-compliance by Valmont with cl 15.2 or for any other reason. It was incumbent on it to do so had this been its intention".

Supreme Court delivers practical guidance on service of payment claims in NSW

Justice Stevenson in MGW Engineering Pty Ltd t/a Forefront Services v CMOC Mining Pty Ltd [2021] NSWSC 514 provides practical guidance on the prescribed methods of service in section 31 of the Building and Construction Industry Security of Payment Act 1999 (NSW).

At issue was the date on which the plaintiff, Forefront, was taken to have served four payment claims on CMOC. Forefront contended service was effected on 3 February 2021 when the claims were hand-delivered at 5:15 pm "personally" to CMOC. But CMOC argued service did not occur until 4 February 2021, when Forefront delivered the same four payment claims to CMOC electronically using Aconex. The timing was critical because if service of the payment claim had occurred on 3 February 2021, CMOC's payment schedule was given outside of the 10-business-day timeframe required by the Act and CMOC would be liable for the total amount Forefront claimed.J

ustice Stevenson examined the types of service provided for by section 31 of the Act relevant in this case and concluded that service had not been effected until 4 February 2021. His reasoning sheds light on the practical application of the service of notice requirements in the Act.

Delivery of a document "to the person personally" – section 31(1)(a) of the Act

For personal delivery to CMOC, "some step must be taken to bring the document to the attention of a relevantly responsible person within the corporation". In this case, hand-delivering the payment claims to a CMOC employee who was on duty at an "access control room" at the mine site was insufficient;

The facultative provision permitting service under section 109X of the Corporations Act 2001 (Cth) did not assist because CMOC's registered office was not the mine, and Forefront did not deliver the documents personally to a director.

"Lodging" the payment claims" during normal office hours" at CMOC’s "ordinary place of business" – section 31(1)(b) of the Act

As with personal service, the "lodging" of documents requires more than simply leaving the documents with an employee of a company. Some further step is needed to bring the payment claims to the attention of the responsible person, which didn’t happen until 4 February 2021;

"office hours" of a person for the Act means the hours that the "administrative or clerical staff of the person [would] normally keep". Although the mine operated continuously 24 hours a day, seven days a week, nothing administrative or clerical took place in the "Access Control Room". The time of delivery (5:15 pm) fell outside normal office hours kept by administrative staff.

Service as provided under construction contract – section 31(1)(e) of the Act.

Section 31(1)(e) of the Act expressly provides that the construction contract may set out the service method. In this case, the notice provision of the contract stated that notice "will be taken to be duly given, in the case of delivery by hand, when delivered". However, the clause had a proviso that notices delivered after 4 pm are taken to be delivered on the next business day. His Honour found that the clause did not modify section 31 of the Act but was facultative. But, since Forefront hand-delivered the documents at 5:15 pm on 3 February 2021, service did not occur until the next business day – 4 February 2021.

Liability reapportioned following Lacrosse cladding appeal ruling

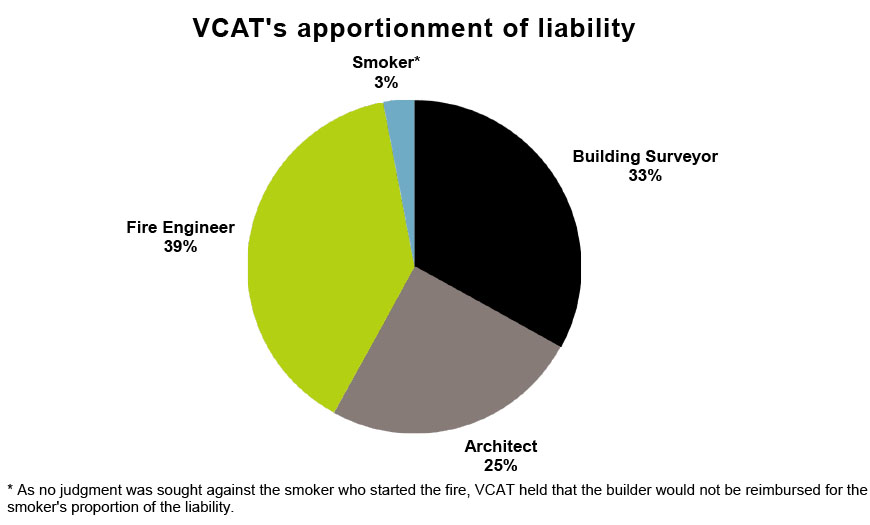

In the latest development in the Lacrosse litigation (which marked the first Australian decision on liability for combustible cladding), the Victorian Court of Appeal has reapportioned liability between the building consultants contracted to LU Simon, the builder of Melbourne's Lacrosse apartment building.

In March 2021, the Victorian Court of Appeal dismissed 10 of the 11 grounds of appeal against the 2019 VCAT decision that ascribed 97% liability for the 2014 fire at Melbourne's Lacrosse building to the fire safety engineer (Thomas Nicolas), building surveyor (Gardner Group) and architect (Elenberg Fraser). However, the Court of Appeal granted Gardner Group leave to appeal against one of the grounds on which it was found negligent. With the Tribunal's finding on this particular issue concerning causation of loss set aside, the Court of Appeal had to reapportion legal responsibility between the consultants.

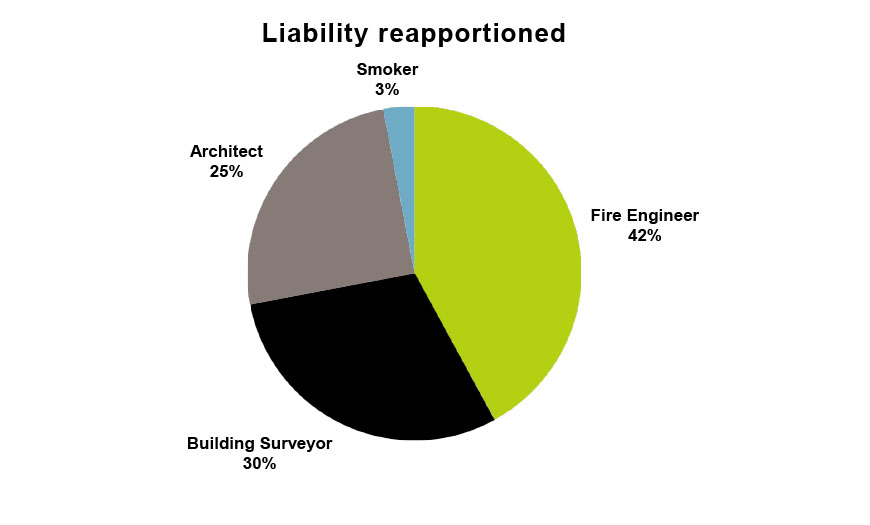

In Tanah Merah Vic Pty Ltd v Owners Corporation No 1 of PS613436T [No 2] [2021] VSCA 122 (12 May 2021), the Victorian Court of Appeal acknowledged that sending the apportionment issue back to VCAT would entail considerable cost and delay for the parties. The Court of Appeal reapportioned liability afresh having regard to:

the consultants’ respective departures from the standards of care expected of them; and

the causative potency of each consultant's conduct,

Reapportioning liability as between the building surveyor and the fire safety engineer, the Court of Appeal reiterated the Tribunal's view of the respective positions in the liability hierarchy that each party occupied. The fire engineer (Thomas Nicolas) sat at the top of the order because it was the "only building professional with knowledge that the ACPs were non-compliant and a fire risk". As such, the fire engineer was uniquely placed to notify of these issues, and its failures had considerable causal potency.

Many aspects of the Lacrosse proceedings turn on the facts of the case. There also significant points of difference between the proportionate liability statutes in force in each State and Territory. However, developers, builders, building professionals and insurers are closely watching these proceedings as cladding rectification activity intensifies.

NSW pushes ahead with its building reform agenda: new Building Legislation Amendment Bill 2021

The Building Legislation Amendment Bill 2021 will, if passed, amend existing building legislation to expand enforcement and compliance powers, crackdowns on developers, and tidy up the regulatory process. The Bill, introduced into Parliament on 12 May 2021, forms part of the Government's efforts to drive behavioural change in the industry following the 2019 Building Confidence Report by Professor Peter Shergold AC and Ms Bronwyn Weir. The Bill's amendments include:

The introduction of a levy on developers (by way of an amendment to the Residential Apartment Buildings (Compliance and Enforcement Powers) Act 2020 (NSW) (RAB Act)) to be paid into the Home Building Administration Fund. The Bill provides that the Residential Apartment Buildings (Compliance and Enforcement Powers) Regulation 2020 (NSW) (RAB Regulations) may deal with levies' imposition. However, in the second reading speech for the Bill, the Minister for Better Regulation and Industry confirmed that the levy would operate on a sliding scale, with larger projects attracting a higher levy. Smaller developments may be eligible for an exemption.

Clarification of section 20 of the Design and Building Practitioners Act 2020 (NSW) (DBP Act) to provide that the building practitioner must take "reasonable steps" to meet the requirements set out in section 20(2) and (3) (as applicable) before varied building work can commence rather than after commencement of the work. Section 20(2) and (3) concern the preparation of designs and design compliance declarations for work to be varied from a regulated design for a building element or performance solution.

Daily Penalties for developers under the RAB Act (on top of the existing penalty) for each day a developer fails to notify the Secretary of the Department of Customer Service (Secretary) of:

the intended completion date; or

a change of expected completion date before applying for an occupation certificate

as well as for failure to comply with a direction from an authorised officer made under Part 3 of the RAB Act.

Court Orders for persons to comply with a direction or order under the RAB Act and RAB Regulations, and following failure to comply with a court order, additional penalties.

Additional grounds for orders prohibiting the issue of occupation certificates and strata plan registrations if a developer for a scheme in relation to a residential apartment building fails to comply with an order to provide information or answers required for an authorised purpose under sections 17 and 18 of the RAB Act (or any other circumstance prescribed by the regulations).

Provision for further regulation regarding recognition of professional bodies of engineers by amending the DPB Act to enable: regulations to be made; adoption and publication of guidelines by the Secretary; and administrative review of the Secretary's decisions,

regarding the recognition of professional bodies of engineers by the Secretary.

Increased flexibility ahead for Northern Australia Infrastructure

The Federal Government has passed its Northern Australia Infrastructure Facility (NAIF) reforms through Parliament. NAIF is a Commonwealth Government agency providing loans to infrastructure projects in the Northern Territory, Queensland and Western Australia. The reforms offer NAIF increased flexibility in its investment offering to support the region's economic recovery from COVID-19.

The Northern Australia Infrastructure Facility Amendment (Extension and Other Measures) Bill 2021 amends the Northern Australia Infrastructure Facility Act 2016 to extend the investment period of the NAIF by five years to 30 June 2026. The original investment window was set to expire on 30 June 2021. But with a slow-moving pipeline in its early years, the NAIF was unlikely to fully invest its original $5 billion allocation without extending the investment window.

Other changes geared at accelerating investment in Northern Australia include:

widening the scope of projects eligible for NAIF financial assistance. The amendments extend NAIF's remit beyond financing the "construction" of physical infrastructure. The reforms will make financial assistance available for infrastructure "development". The Minister notes that this change will make NAIF finance available to "additional elements of infrastructure construction, such as equipment purchases or leasing, training, and the expansion of existing business operations". The amendments also broaden funding eligibility by including projects that meet either criterion of providing a basis for economic growth in Northern Australia or stimulating population growth in Northern Australia. Previously, both of these formed mandatory criteria.

allowing NAIF to lend directly to project proponents in certain circumstances. Previously the Facility could only provide financial assistance to the States and Territories. These changes will streamline the lending process and reduce the administrative burden.

increasing NAIF's investment offering and risk appetite by lifting the prohibition on NAIF making equity investments.

WA SOP reform back on the agenda

WA's overhaul of its security of payment laws is back on the agenda, with the Building and Construction Industry (Security of Payment) Bill 2021 (2021 Bill) introduced into State Parliament on 25 May 2021. The 2020 Bill, passed by the WA Legislative Assembly, lapsed when State Parliament was prorogued in December 2020. According to the Explanatory Memorandum, the 2021 Bill is largely in the same form as the 2020 Bill, save for some technical amendments and amendments "to improve clarity and operation".If adopted, the amending legislation will bring WA's regime more closely into alignment with the "East Coast" security of payment model. We will keep you updated on further developments.

Get in touch