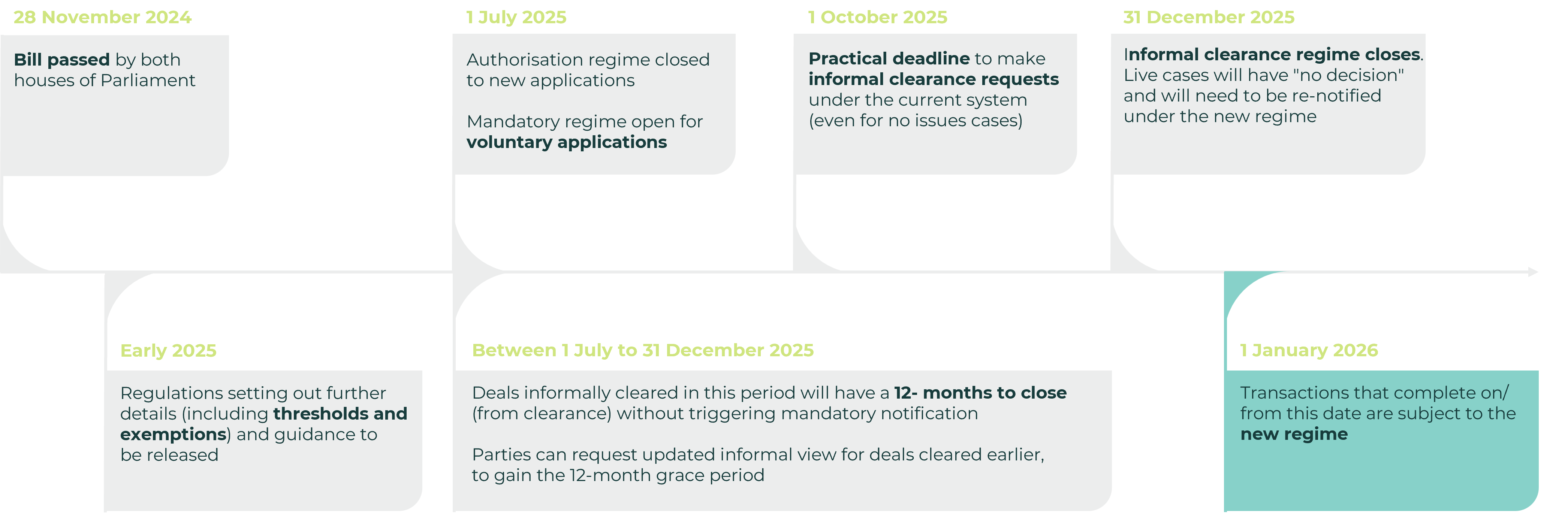

Merger control in Australia is going through a major overhaul, moving to a single mandatory and suspensory administrative regime. The new mandatory regime will apply to all deals closing or completing on or after 1 January 2026 (even if signed earlier). The ACCC is already transitioning to the new regime, so it's important to start factoring it into transaction timelines now.

Keep across these changes and what they mean for your business and deal pipeline on our one-stop merger reforms hub. We'll be continually updating with new insights and analysis as we transition to the new regime, so check back in to keep up with the latest developments.

Where are we now?

Video highlights

Australia's new mandatory merger controls: a discussion with ACCC chair Gina Cass Gottlieb

ACCC Chair, Gina Cass-Gottlieb joined Clayton Utz Competition Partners, Kirsten Webb, Michael Corrigan and Mihkel Wilding to discuss the regime, which will apply to all deals closing or completing on or after 1 January 2026 (and on a voluntary basis from 1 July 2025). See video highlights from the discussion below.

Get in touch