The ACCC's new merger regime is live! Here's what you need to know

Australia’s new merger regime has now taken effect on a voluntarily basis, ushering in significant changes to how mergers and acquisitions are assessed by the ACCC. Whether you’re planning a transaction or simply keeping an eye on regulatory developments, here’s a quick guide as to what’s changed and what it means for you.

What's changed in merger clearance?

Businesses can now voluntarily notify the ACCC of proposed mergers and acquisitions under the new regime.

Notification under the existing informal system is still an option, however, businesses wishing to have transactions cleared under the existing regime must do so without delay.

Parties approaching the ACCC after 1 October 2025 risk the ACCC not reaching a decision before 31 December 2025, meaning re-notification will be required.

The ACCC has created a new acquisitions page where new applications will be posted.

Final thresholds confirmed

The new regime applies to acquisitions of shares or assets which are connected with Australia and which meet certain thresholds and which have now been finalised by the Government:

Acquisitions resulting in large corporate groups

The combined Australian revenue of the merger parties > A$200 million; and

The target business or assets being acquired have an Australian revenue >A$50 million; or

The transaction has a market value of or the consideration paid is >A$250 million.

Acquisitions by very large corporate groups

The acquirer has Australian revenue >A$500 million; and

The target business or assets being acquired have an Australian revenue >A$10 million.

Serial acquisitions

The combined Australian revenue of the parties > A$200 million; and

Cumulative Australian revenue from similar acquisitions in previous 3 years was at least A$50 million (disregarding acquisitions which were previously notified to the ACCC).

or

The acquirer has Australian revenue >A$500 million; and

Cumulative Australian revenue from similar acquisitions in previous 3 years was at least A$10 million (disregarding acquisitions which were previously notified to the ACCC).

Acquisitions of entities with revenue of less than A$2 million are excluded from this assessment.

The thresholds now refer to Australian revenue, as determined in accordance with accounting standards, being revenue attributable to transactions or assets within Australia, or transactions into Australia

Connection to Australia: what’s changed?

The "connection to Australia" test has also been updated. This test determines whether a transaction has sufficient nexus to Australia to fall within the ACCC’s jurisdiction.

The test now focuses solely on businesses currently carrying on business in Australia, excluding entities which may only have intentions to operate in Australia in the future (as was previously contemplated by the draft instrument).

What will be public during the ACCC's reviews under the new system?

The Government has now also confirmed what will be published on the ACCC's Merger Register about all notified matters including requests for waivers. This includes:

the parties' identifying information;

a non-confidential summary of the acquisition;

a copy of each determination in relation to an acquisition and a statement of reasons;

a copy of any phase 2 notice;

summary statements regarding the following (where applicable):

any decision on a waiver application;

details of any extension to the determination period;

if any consultation is ongoing and the nature of that consultation; and

if a notice of competition concerns has been issued, a summary of that notice.

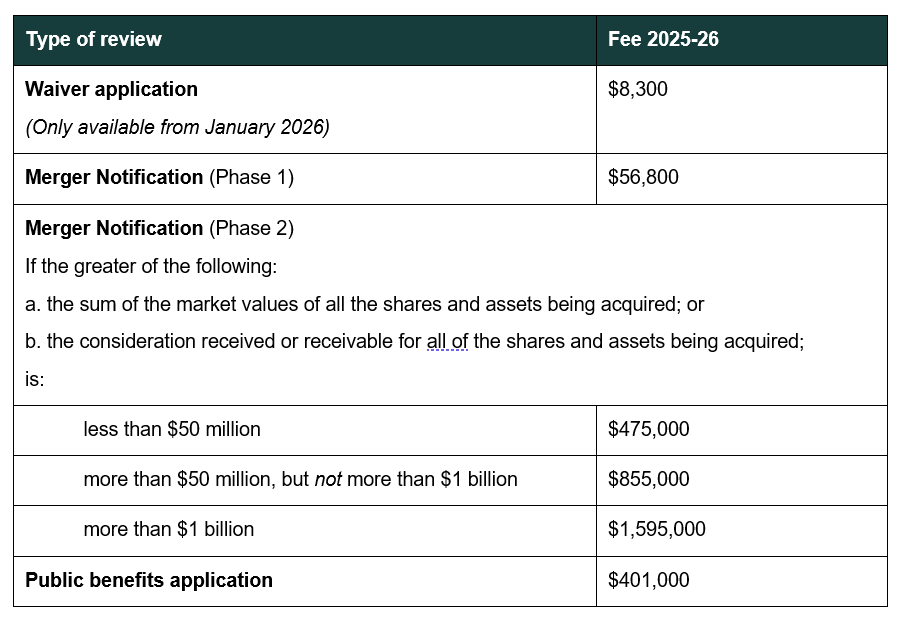

The price tag on the new regime

One key change since the Treasury’s consultation paper is the updated filing fees for notifying transactions.

Businesses should factor these costs into their transaction planning. Fee exemptions will be available for small businesses.

What's next?

Businesses requiring ACCC approval this year should lodge any request for informal review as soon as possible. The ACCC will not continue a review if it has not been finalised by 31 December 2025 (these transactions will be recorded on the ACCC's register as having "no decision").

It is also important for businesses to review the thresholds above to assess whether their transactions may require notification.

Get in touch