Stemming the tide of biodiversity loss through nature-related financial disclosures

First announced by the United Nations in July 2020, the new Task Force on Nature-related Financial Disclosures (TNFD) is steadily gaining momentum following the recent backing by the G7 and endorsement by major financial institutions and multinational corporations.

Recognising that more than half of the world's economic output ($US 44trillion of economic value generation) is dependent on nature, and with approximately 83% of wild mammals and half of all plants having already been wiped out, the TNFD seeks to catalyse a shift in global financial flows away from negative impacts (including pollution of air, water and ecosystems) toward nature-positive outcomes by driving accountability, transparency and supporting organisations to report and act on nature-related risks.

The TNFD will build on the success of the widely-embraced voluntary framework created by the Taskforce on Climate Change Financial Disclosures (TCFD) established to help organisations make financial disclosures on climate-related risks. The TCFD has been credited with the mainstreaming of climate-related issues within organisations, solidified further by the G7s recent announcement that it is moving towards mandating climate-change disclosures based on the TCFD framework. The TNFD hopes to have similar success with nature-related environmental risks.

The TNFD initiative is separate to the draft Global Biodiversity Framework developed under the 1993 United Nations Convention on Biodiversity. The first draft of the Global Biodiversity Framework was released on 12 July 2021 and promises a 'Paris-style' biodiversity agreement for the 196 parties to the Convention. However there is congruence with the TNFD objective to drive accountability of nature-related risks, as one of the 10 milestones of the draft Global Biodiversity Framework includes that nature and its contributions to people are fully accounted and inform all relevant public and private decisions.

Nature and biodiversity loss is an unmeasured risk

Currently, financial systems are not fully aware of nature-related risks and externalities and those risks are rarely reported or quantified by companies. According to the David Craig, TNFD Co-Chair, the extent of this biodiversity "finance gap" is equivalent to the GDP of Switzerland. In this context, the wide range of stakeholders that have endorsed that TNFD have cited the need for a common valuation framework – essentially the same baseline to measure the cost of nature and biodiversity loss.

A key remit of the TNFD is to raise awareness and build the capacity and capability of organisations to enable them to understand how their operations and investments impact and depend on nature, and therefore the extent of their exposure to nature-related financial risk.

One of TNFD's goals is to create opportunities for the protection and restoration of the natural capital assets upon which our world economy depends, and so better align economic activities with the Sustainable Development Goals (SDGs) and help to ensure respect for internationally-recognised human rights – including the rights of indigenous peoples and local communities that play a key role in safeguarding nature.

How will the TNFD framework enhance disclosures?

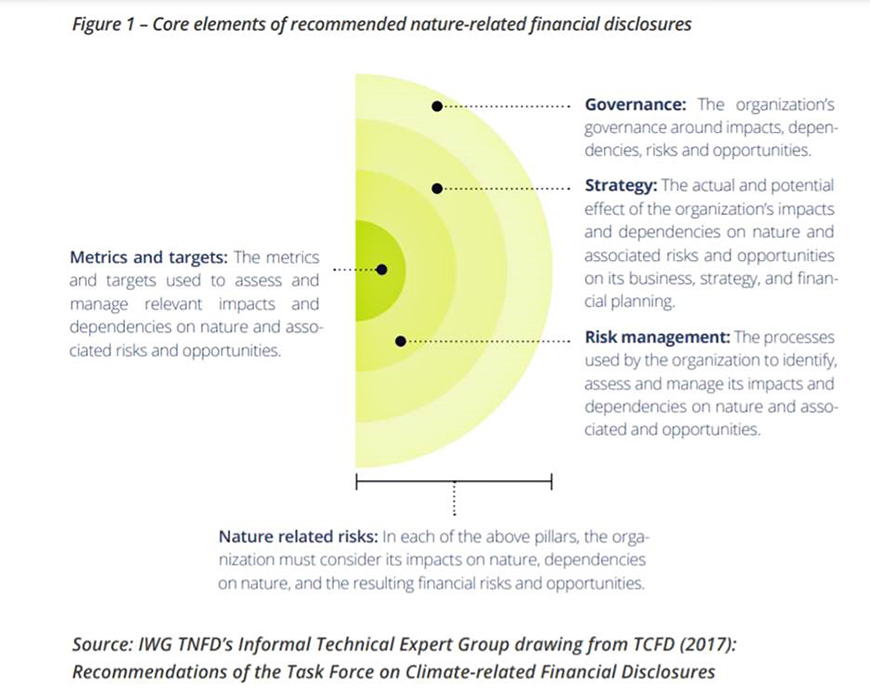

Due to be finalised in 2023, the TNFD framework for disclosures will be structured into four core pillars shown in Figure 1.

This approach to risk is consistent with TCFD’s broad approach to financial materiality that extends beyond immediate risks to consider transition risks through the use, for example, of scenarios. The TNFD will broadly seek to align with the two global targets in the UN Convention on Biological Diversity's zero-draft Global Biodiversity Framework of “no net loss by 2030 and net gain by 2050.

The TNFD's preparatory report titled 'Nature in Scope' indicates that nature-related financial risks will be placed in two broad categories:

- physical risk and opportunities: the physical risks are those that result from natural loss which may be event driven (acute) or longer-term. These losses may have financial implications for organisations including direct damage to assets, as well as financial implications for other parties, such as financial losses in the agricultural sector from reduced pollination from insects and global financial losses in medicine. Opportunities include increased resilience of business production processes or demand.

- transition risks and opportunities: transition risk entails the potential financial impact due to changes in policy, legal, technology and market changes that penalise negative impacts on nature, which can have impacts on a company's reputation, compliance and litigation. The possibility of stranded assets also looms large in the transition risk. Transition opportunities are when an organisation benefits financially due to changes in market preferences/demands that reward the positive impact they have on nature.

The 'Nature in Scope' report also flags that the framework will identify nature-related 'systemic risk' such as systemic loss of soil fertility. Systemic risk can have multiple elements, but TNFD-aligned reporting entities will be required to report on (i) the risk that a critical natural system no longer functions properly and (ii) the risk that arises at a portfolio-level of a financial institution.

The need for data

A current dilemma with for corporate and financial disclosures related to environmental, social and corporate governance (ESG) is that the reporting is often policy-centric and lacks metrics and data. This results in "black box" reporting where a company's environmental risk lacks real meaning and transparency.

Elaborating on this issue, Michelle Edkins, Managing Director of Blackrock commented that:

"As investors, we are looking for reporting that is consistent, comparable and decision-useful. Most reporting is a combination of narrative and data. For nature-related issues, we are long on narrative, but we are short on data that is proven to help companies and investors measure a company’s impacts and dependencies on nature and how well they are managing the risks arising from those impacts and dependencies." [emphasis added]

Similarly, the proposed Technical Scope for the TNFD notes that nature-related data is "typically piecemeal, disparate and inconsistent, as that data is not integrated into metrics and measures appropriate for these actors. The level of corporate nature-related data collection and disclosure is therefore low."

To overcome this hurdle, the TNFD seeks to generate increased demand for use, interpretation and improvement of existing data, as well as create new data where it is not available and make data more accessible. It is hoped that this will lead to more informed decision-making by companies and more sustainable investments.

What to expect

Importantly, the TNFD does not intend to create new standards but align with and draw from existing initiatives, frameworks and standards relevant to nature-related risks and opportunities.

The TNFD will produce more detailed technical guidance for reporting entities on how to fulfil the requirements of the framework for example, guidance on metrics, what types of data can be used, example responses, and how to prioritise. The TNFD will also provide broader guidance on how to identify, assess and manage nature-related risks and opportunities, and will support other actors to develop frameworks and standards in these areas.

It is likely that TNFD follow a similar trajectory to the TCFD where there will be increasing regulatory and market pressure on companies to adopt the framework and make the recommended nature-related financial disclosures, in addition to climate-change disclosures. As awareness rises on nature-related risks, companies should also expect investors to increasingly favour business models that offer nature-positive outcomes.

Companies that are highly dependent on nature or have significant impacts (such as biodiversity loss, pollution and ecosystem degradation) should start identifying exposure to nature-related risks now, and be particularly wary of assets that are at risk of becoming stranded during the transition towards nature-positive economies.

In equal measure, companies ought also to prepare a strategy to capitalise on the significant opportunities that are presented by the transition to a nature-positive economy, which the World Economic Forum estimates will unlock an estimated $USD10 trillion of annual business opportunities and create 395 million jobs by 2030.

Get in touch