Foreign investment in Australia in October – December 2024: key insights from the latest quarterly report

The Australian Treasury has released its quarterly report on foreign investment for 1 October to 31 December 2024 (Q2 2024/25), offering insights into foreign investment activity in Australia, highlighting key trends, sectoral shifts, and processing developments.

Headline statistics and takeaways from Q2 2024/25:

The United States remains Australia's largest source of foreign direct investment, though its investment value has declined compared to the previous quarter.

Saudi Arabia has emerged as a significant investor, ranking second by value of approved commercial investment proposals.

The "finance & insurance" sector overtook "commercial real estate" as the leading industry sector for foreign investment.

Median processing times for commercial investment proposals have improved, with Treasury achieving a median of 29 days, down from 34 days in the previous quarter.

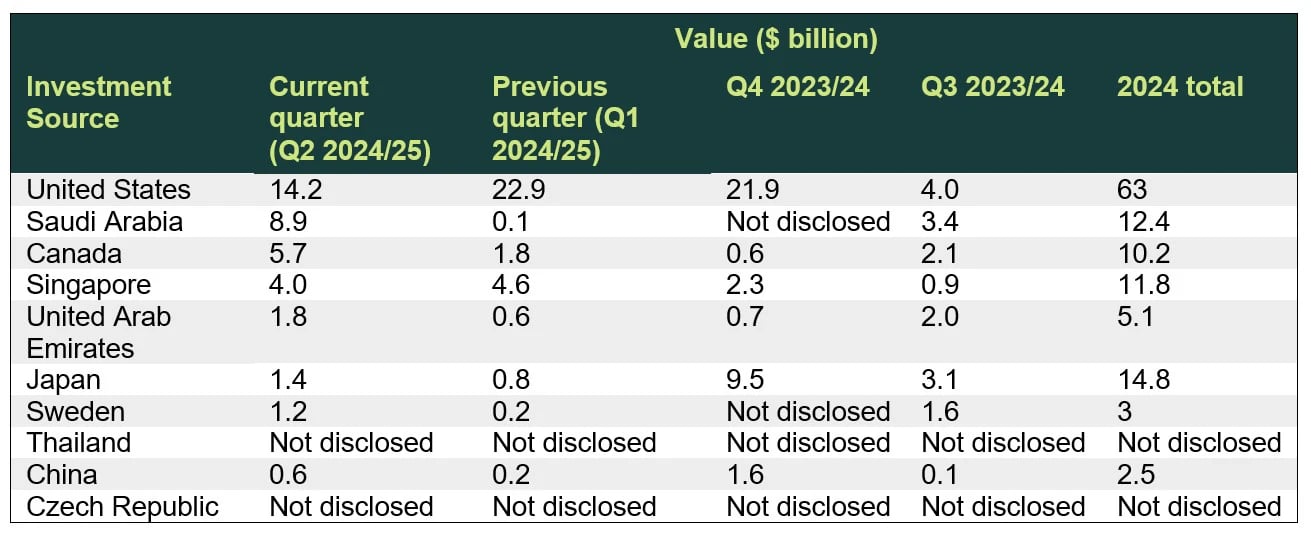

Australia’s top investors

The United States continues to dominate as Australia’s largest source of foreign direct investment, with total approved commercial investment value of $14.2 billion (down from $22.9 billion recorded in Q1 2024/25). Saudi Arabia followed with $8.9 billion in approved investments (marking a significant rise from $0.1 billion in Q1 2024/25). Canada ($5.7 billion), Singapore ($4.0 billion), and the United Arab Emirates ($1.8 billion) rounded out the top five investor countries.

Japan and Sweden also featured prominently, while China’s investment value remained modest at $0.6 billion. The total value of commercial investment proposals in Q2 2024/25 rose to $54.7 billion, up from $46.6 billion in Q1 2024/25.

In residential property, China and Singapore led with $0.3 billion each, followed by Taiwan, Vietnam, and Hong Kong ($0.1 billion each).

Looking at data for the 2024 calendar year

The table below identifies the top 10 countries investing into Australia in the last quarter and the value of their commercial investments over the 2024 calendar year:

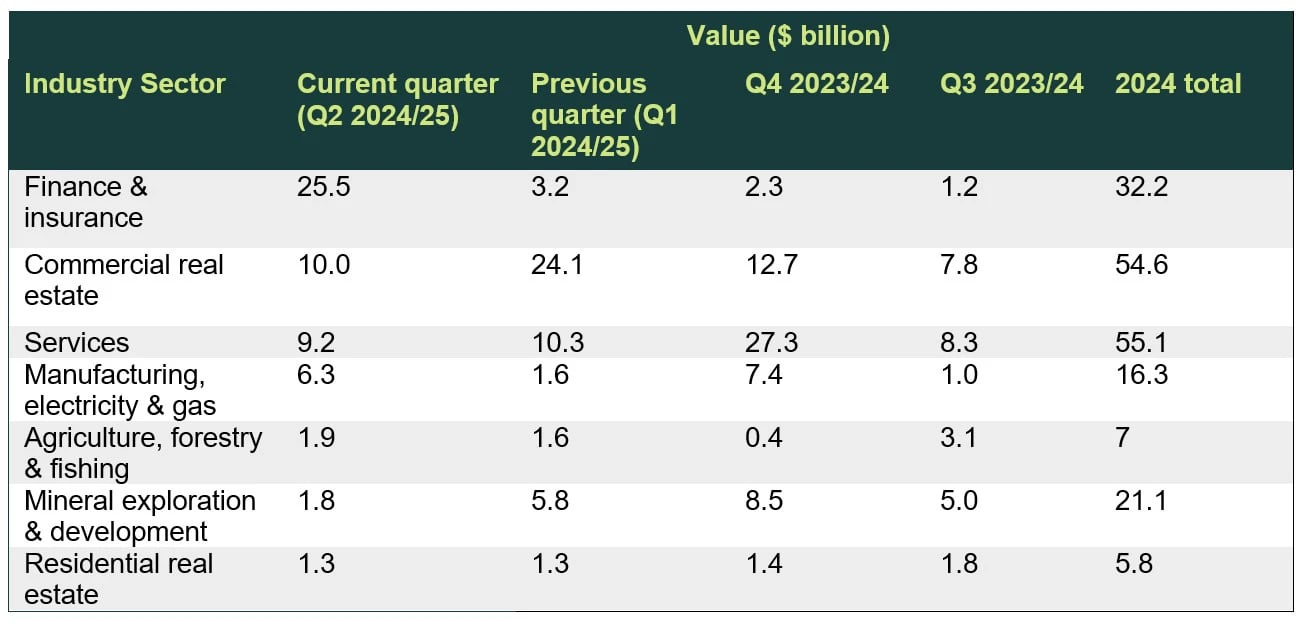

Investment by industry sector

The "finance & insurance" sector dominated Q2 2024/25 with $25.5 billion in approved investments, a significant increase from $3.2 billion in Q1 2024/25. The "commercial real estate" sector, which led in the previous quarter, saw a decline to $10.0 billion (down from $24.1 billion in Q1 2024/25).

Other dominant sectors this quarter included services ($9.2 billion), manufacturing, electricity & gas ($6.3 billion), and agriculture, forestry & fishing ($1.9 billion). The mineral exploration & development sector, which has historically been a strong performer, saw a further decline to $1.8 billion.

Looking at data for the 2024 calendar year

Approved commercial investments

During Q2 2024/25, a total of 351 commercial investment proposals were approved, amounting to a combined value of $54.7 billion. Of these, 117 were approved with conditions, while 234 were approved without conditions. By monetary value, approximately 77% of all investment approvals in Q2 2024/25 had conditions imposed on them ($42.3 billion out of $54.7 billion).

Withdrawn commercial applications

A total of 40 commercial investment applications were withdrawn in Q2 2024/25, representing around 11% of applications. This is an increase from 29 withdrawals in the previous quarter.

National security applications

Of the 351 approved commercial investment proposals, 35 were classified as national security actions. These were divided into:

Mandatory notifications: 24 approvals (2 with conditions, 22 without conditions); and

Voluntary notifications: 11 approvals (1 with conditions, 10 without conditions).

Processing times

Treasury's median processing time for approved commercial investment applications was 29 days, reflecting an improvement from the previous quarter’s 34 days. Treasury processed 52% of approvals within 30 days or less and approximately 80% within 60 days or less.

This improvement aligns with the Treasurer’s target of processing 50% of cases within statutory timeframes from 1 January 2025. The rollout of the new Foreign Investment Portal, now fully operational, may further enhance efficiency.

The latest data report underscores a dynamic foreign investment landscape, with shifts in investor countries and industry preferences. For businesses and investors navigating Australia’s foreign investment framework, staying informed is essential. For further information or assistance with foreign investment matters, feel free to reach out to our team.

Get in touch