Time is running out for Victorian developers before new owners corporations obligations and restrictions commence

Significant changes to the Owners Corporations Act 2006 (OC Act), as well as other amendments to the Retirement Villages Act 1986 and the Subdivision Act 1988, are due to take effect from 1 December 2021 (unless proclaimed earlier). There are some key changes that will impose increased obligations and restrictions on developers as the "initial owner" of an owners corporation, so with less than three months to go, it is imperative that developers revisit these amendments and satisfy themselves that no changes will be required to owners corporations proposed for their developments.

Additional obligations on the developer

The applicant for registration of a plan of subdivision (ie. the developer) must disclose at the Inaugural General Meeting, and ensure the minutes of that meeting record:

- any relationship it has with the owners corporation manager;

- any immediate or future financial transactions that will, or will foreseeably, arise out of its relationship with the owners corporation manager; and

- any specific benefits that flow to the developer as a result of that relationship.

The following additional documents also need to be provided by the developer at the Inaugural General Meeting:

- a maintenance plan;

- the building maintenance manual;

- an asset register;

- copies (or at a minimum if copies are not available, details) of any warranties; and

- copies of any specifications, reports, certificates, permits, notices or orders in relation to the plan of subdivision.

The initial owner must not propose a budget for an owners corporation that is unreasonable or unsustainable, and must not designate as a private lot what would normally be common property or services.

Certain contracts must not exceed three years

The term of a contract appointing a manager of any owners corporation which is not in a retirement village must not exceed three years.

Any contract other than a contract of appointment entered into by the developer that relates to the owners corporation and benefits the developer is similarly limited to a term not exceeding three years. Arguably, contracts that are entered into by a third party (as opposed to the developer), or which do not benefit the developer, will not be subject to the three year limit. If you are contemplating entering into such a contract, you should nonetheless seek legal advice. While the proposed arrangement may not fall squarely within those that are expressly prohibited, there is still an overarching duty on the developer as initial owner to act honestly and in good faith and with due care and diligence in the interests of the owners corporation.

It is also important to note that the period for which this obligation of good faith is imposed on the initial owner has been extended to a period of 10 years following registration of the plan (increased from five years) and applies while the developer is the owner of a lot or lots to which are attached the majority of the lot entitlements (rather than simply the majority of the number of lots).

These restrictions are intended to further restrict any ability for a developer to have an interest in a long-term contract, which is on unfavourable terms or on terms which benefit the developer to the detriment of the owners corporation.

A last minute amendment was made to the amending Act to include a carve-out for hotel and resort management contracts relating to hotels, resorts and serviced apartment complexes. This includes:

- a letting agreement to an onsite letting manager;

- an agreement to use common property for the purposes of operating an on-site letting business or provision of caretaking services; or

- a building maintenance or facilities management agreement.

However, the regulation-making power under the OC Act has been amended so that the Governor in Council may make regulations prescribing requirements for hotel and resort management contracts including restricting the term of those contracts, limiting or placing parameters on fees and charges and prohibiting or regulating the inclusion of specified terms and conditions. To date, no such regulations have been made.

Other restrictions on appointments

If the developer has appointed a third party manager (that is, one who is not the developer or a lot owner) prior to the first meeting of the owners corporation, that contract of appointment will expire at the first meeting.

Developers and their associates may not be appointed as manager of the owners corporation. It is however important to note the definition of "associate" for this purpose under the OC Act, as whilst it includes directors, employees or agents, and direct relatives, it does not appear to expressly capture a related corporation as defined in the Corporations Act (noting however such an entity may still be an agent).

The amendments introduced by the OC Act also set out certain terms which cannot be included in a contract of appointment of an owners corporation manager. These include terms:

- requiring the owners corporation, before revoking the appointment of the manager, to pass a special resolution, a unanimous resolution or any other resolution requiring more than a simple majority of votes, or to convene a general meeting of the owners corporation, or to take any other prescribed step;

- permitting the manager to renew the contract at the manager's option;

- requiring a tier one or tier two owners corporation to give three months or more notice of its intention to revoke the manager's appointment;

- requiring a tier three, tier four or tier five corporation to give one month or more notice of its intention to revoke the manager's appointment;

- providing for the automatic renewal of the contract if the owners corporation fails to give notice it does not intend to renew; and

- restricting the ability of the owners corporation to refuse consent to assignment of the contract, other than a requirement that such consent must not be unreasonably withheld.

Significantly, a developer must not receive any payment from the manager in relation to the manager's contract of appointment.

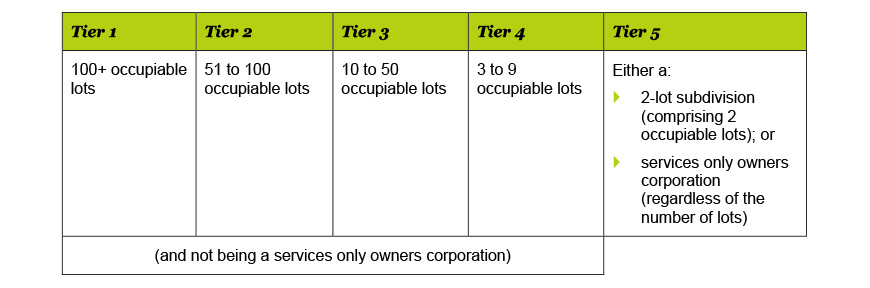

Categorisation of owners corporations into tiers

From commencement of the amendments, owners corporations will fall into one of the following five tiers. Tiers will be determined based on the number of occupiable lots, replacing the concepts of prescribed and non-prescribed owners corporations, and will have different obligations, including those as to preparation (and in some cases audit) of financial statements and preparation of maintenance plans, depending on which tier they are in:

The definition of a "services only owners corporation" has been introduced, being an owners corporation:

- without common property; and

- either the initial owner of the subdivision has arranged for a utility company to install common meters that are designated as the common property, or the subdivision will have an unmetered common supply or common service that is unmetered.

However, if an owners corporation consists:

- solely of non-occupiable lots (being a car park, a storage locker or other lot that is not ordinarily used for residential or business purposes); or

- of less than 10 occupiable lots and more than 50 non-occupiable lots,

the relevant tier for that owners corporation will be determined in accordance with the above table as if a reference to an occupiable lot were a reference to a non-occupiable lot. For example, if the owners corporation has five occupiable lots and 60 non-occupiable lots, it will be designated as Tier 2 owners corporation.

The amount of annual fees levied by an owners corporation will no longer be a factor which determines the extent of the owners corporation's obligations.

Changes to allocation of lot liabilities and lot entitlements and annual fees

The Subdivision Act 1988 will be amended to impose new requirements on the initial allocation of lot liability and lot entitlements. In particular, the initial owner must engage a surveyor to set out the initial allocation of lot liability and lot entitlement (unless the owners corporation is a tier five owners corporation), and the plan must be accompanied by a statement detailing how the lot entitlement and lot liability have been allocated, having regard to the following principles:

- lot liability must be allocated equally between lots on a plan, unless:

- there is a substantial difference in lot size, in which case the lot liability must be allocated on the basis of the size of the lot and the proportion that size bears to the total size area of the lots;

- different lots have a bearing on the consumption or use of common utilities or the cost of maintaining the common property, in which case the lot liability must be allocated on the basis of the size of the lot and level of consumption or use by that lot of the common utilities and the common property; or

- the number of occupiers in each lot has a greater bearing (than the size of the lot) on the consumption or use of common utilities or the cost of maintaining the common property, in which case the lot liability must be allocated on the basis of the number of bedrooms in the lot; and

- lot entitlement must be allocated by the proportion that the market value of the lot bears to the total market value of all the lots on the plan.

The amendments to the Owners Corporation Act 2006 will also mean that annual owners corporation fees payable by each lot owner will no longer need to be set based solely on lot liability. An additional annual fee can also now be charged to lot owners on the basis of a 'benefit' principle if:

- the owners corporation has incurred additional costs arising from the particular use of the lot by the lot owner; and

- an annual fee set on the basis of the lot liability of the lot owner would not adequately take account of those additional costs.

Conclusion

Many of the amendments that will come into effect on 1 December 2021 are directed at streamlining the operation of the OC Act, particularly in relation to owners corporations in large developments with large numbers of lot owners who may either be absent or disinterested in the workings of the owners corporation. However, developers must familiarise themselves with those amendments which impose additional obligations on the initial owner at the time of registration of the plan.

Where applicable, developers must ensure that any agreements they propose to enter into following registration of the plan of subdivision do not infringe the new requirements, including those as to both the length of term of the agreement and receipt of any payment or commission. We are able to assist in reviewing and advising on current arrangements or preparing new documents that comply with the most recent changes.