Real estate: 5 Minute Fix 07

Qld: New editions of REIQ contracts

The Queensland Law Society (QLS) and the Real Estate Institute Queensland (REIQ) have released new editions of the four standard form Qld REIQ contracts. The amendments outlined by QLS include:

- the addition of e-conveyancing clauses to the Commercial Land & Buildings contract and the Commercial Lots in a Community Titles Scheme contract to accommodate electronic settlements;

- updates to all e-conveyancing clauses to refer to electronic lodgement network operators generally; and

- updated natural disaster clauses to refer to “Delay Events”, including the imminent threat of such an event.

Qld: Proposed amendments to Brisbane City Council City Plan 2014 –restricting townhouses in low density residential zone

Brisbane City Council is proposing to amend City Plan 2014 to restrict construction of townhouses in low density residential zones by:

- removing provisions in zone codes, development codes and neighbourhood plans supporting multiple dwellings (townhouses and apartments) in the low density residential zone; and

- amending other relevant provisions in City Plan to align with this change, including amendments to the Strategic Framework, and make necessary consequential amendments.

For further details, see: Proposed amendments to BCC City Plan

NSW: Transgrid now a prescribed authority for easement purposes

On 16 August 2019, the Conveyancing (General) Amendments (Transgrid Services Pty Limited) Regulation 2019 (385 of 2019) (NSW) commenced which prescribed Transgrid Services Pty Limited as an authority in whose favour an easement without a dominant tenement (ie. benefitted parcel of land) may be created for the purpose of, or incidental to, the supply for a utility service to the public.

The effect of this regulation means that Transgrid now falls within the definition of a "prescribed authority" in section 88D of the Conveyancing Act 1919 (NSW) and now has the power to register an easement associated with its electricity network over a parcel of land, without needing to identify a parcel of land which is benefitted by the easement.

NSW: beware – your market rent review mechanism may be more restrictive than you think

In Strike Australia Pty Ltd v Data Base Corporate Pty Ltd (2019) NSWCA 205, the NSW Court of Appeal determined that a market rent review carried out under a clause requiring a valuer to "have regard to… market rents… for comparable premises in the vicinity of the premises" must only have regard to such premises and must not consider others that were outside the vicinity of the premises.

The key takeaways from this case are:

- to ensure that, when a valuer is engaged to determine market rent, a copy of the lease (or sublease) provisions regarding market rent must be provided; and

- for new leases (or subleases) being entered into, careful consideration must be given to the drafting of clauses to ensure there is no ambiguity as to what premises are to be treated as comparable premises for market rent review purposes.

NSW: draft code of conduct and safety standards for short-term rental accommodation

The Department of Customer Service together with the Department of Planning, Industry and Environment are seeking feedback on the following draft documents:

- Fair Trading Amendment (Code of Conduct of Short-Term Rental Accommodation Industry) Regulation 2019. This regulation proposes to declare a code of conduct for the short-term rental accommodation industry which will apply to online booking platforms, letting agents, hosts and guests;

- State Environmental Planning Policy (Short-term Rental Accommodation) 2019. This policy proposes to introduce exempt and complying development pathways for short-term rental accommodation; and

- Environmental Planning and Assessment Amendment (Short-term Rental Accommodation) Regulation 2019 and the accompanying "Short Term Rental Accommodation Fire Safety Standard". This regulation introduces new safety standards for dwellings used in short-term rental accommodation,

on or before 11 September 2019.

The Departments are seeking feedback from the community, government agencies, councils and industry stakeholders. For details on how to give feedback please visit the Department of Planning's website.

Retail Leases Comparative Analysis updated for all jurisdictions

A South Australian Bill tabled in early July proposes some significant amendments to the Retail and Commercial Leases Act 1995 (SA). Among other things, the Bill confirms that a lease may slip in and out of the ambit of the Act depending on whether the rent payable at any time during the term falls below a prescribed threshold, subject to certain registration exemptions.

Northern Territory: commercial leases – "fair market rent” determination for a hotel with gaming machines

In Majestic Logistics Pty Ltd v Dowling Holdings Pty Ltd (2019) ACML 85-459; [2019] NTSC 50, the Northern Territory Supreme Court held that a hotel’s gaming machines and the income derived from them could be considered by a valuer when determining the “fair market rent” for the hotel premises if not otherwise excluded.

The Court further determined that in the circumstances the valuer was not required to consider the gaming machines and income in assessing the fair market rent, but that consideration of the gaming machines and income was a matter entirely for the valuer to decide.

Western Australia: strata reform

The public consultation process on WA's strata framework is opening in September 2019 alongside the proposed strata regulations becoming available for review.

The proposed amendments to the existing strata regime are intended to include better information for strata buyers, a more efficient process for resolving strata dispute and extensive improvements to how strata schemes are managed.

Together with the strata reforms, community title will be introduced into Western Australia upon proclamation of the Community Titles Act 2018.

Victoria: New economic entitlement stamp duty on development agreements

As foreshadowed in our June 5 Minute Fix, a new stamp duty is payable on development agreements and other arrangements to acquire an "economic entitlement" in relation to Victorian land with an unencumbered value of $1 million or more, which are entered into on after 19 June 2019. The duty is payable within 30 days of entering into the relevant agreement.

Unlike the prior "economic entitlement" duty provisions, the developer will be treated as acquiring a beneficial ownership in the land and will be required to pay stamp duty calculated on the developer's percentage interest in the profits multiplied by the unencumbered value of the land even if the developer is not entitled to 50% or more of the profits.

Note also that:

- a developer will be deemed to have obtained a 100% beneficial ownership of the land in certain circumstances and be required to pay stamp duty on the entire encumbered value of the land; and

- individuals, discretionary trusts, private companies and unit trusts as well as listed companies and trusts are all caught under the new provisions.

However, the Commissioner has issued a guideline indicating that the new regime is intended to capture "arrangements that provide for rights that are economically equivalent to ownership interests", and as such, "ordinary fees for service such as real estate agent fees…calculated on a commission basis are not considered to be an economic entitlement". Based on this guideline, it appears that architects, project managers and planning consultants receiving a "genuine industry fee for service" will also be excluded from paying duty on those fees.

Developers should carefully consider these changes when structuring development agreements, especially where the development fee is to be calculated by reference to the sale proceeds or profits of the development.

For more details on the new duty and the other changes implemented by the State Taxation Acts Amendment Act 2019, see: Sweeping Victorian stamp duty changes will affect corporate restructures, property developments and foreign investment

Victoria: Cladding update

On 16 July 2019, Premier Daniel Andrews announced the establishment of a new agency, Cladding Safety Victoria, to oversee the implementation of a $600 million program to fix residential buildings in Victoria identified by the Victorian Cladding Taskforce and Victorian Building Authority as having combustible cladding.

The Victorian Government will directly contribute $300 million towards the program and, at this time, it appears the other $300 million will be raised by increases to the building permit levy for certain projects with construction costs of $800,000 or more, to be levied over the next five years.

At a public briefing at the Property Council Cladding forum on 29 August 2019, Dan O'Brien, the CEO of Cladding Safety Victoria, indicated that 15 buildings have been identified by the Taskforce as being of highest risk, and that face to face meetings with the Owners Corporations of these buildings would commence by the end of 2019 to discuss rectification works.

Mr O'Brien also indicated that Cladding Safety Victoria will explore performance solutions where available to satisfy the requirements for an occupancy permit to be issued for a fire safe building, instead of requiring cladding to be removed.

Until draft legislation is available for review, it remains to be seen how the Victorian Government will address:

- how the Government's $600 million will be allocated to each of the estimated 1,000 residential buildings which will be identified as affected by combustible cladding at the end of the Victorian Building Authority's audit;

- how the rectification of affected buildings will be funded after the initial $600 million has been allocated;

- the property industry's concerns that significant increases to the building permit levy will result in some projects becoming commercially unviable;

- the increased costs of insurance premiums faced by owners, builders and developers to insure for combustible cladding risk (if such cover is available at all); and

- the lack of availability of qualified, experienced building surveyors to assist with assessing and rectifying combustible cladding.

For an update regarding how combustible cladding issues are being addressed nationally, see Combustible cladding: Building a solution 01

Victoria: land transfers with complex duty assessments now assessed and transacted online

As mentioned in our June 5 Minute Fix, Land Use Victoria has mandated that land transfers which involve complex duty assessments must be assessed and transacted online from 1 August 2019. For such assessments, duty must be assessed by the State Revenue Office at least 30 days prior to settlement, after which such land transfers may only be completed using an electronic lodgement network.

Purchasers in particular should bear this 30 day assessment timeframe in mind when negotiating the settlement date in contracts for sale, and consider if it is necessary to begin preparing any evidentiary duty assessment documentation (eg. property valuations), ahead of exchange in anticipation of settlement.

Victoria: more Victorian cases pushing the boundaries of what constitutes a retail premises

Two VCAT decisions in July 2019 have considered the application of the Retail Leases Act 2003 (Vic) (RLA) to leases of industrial premises and relevant consequences, including whether a landlord of such premises is entitled to recover land tax and other outgoings from a tenant.

When entering into leases which, on the face of it, are for an industrial and not a retail use, both landlords and tenants should carefully consider if the lease will fall within the ambit of the RLA and ensure lease negotiations take this into account.

Key takeaways from the recent VCAT cases include:

- references to a "building" in various parts of the RLA do not necessarily mean that the word "premises" needs some form of infrastructure on the land. It is therefore possible for a retail business to be conducted on undeveloped land and for a ground lease to constitute a lease of retail premises (Phillips v Abel [2019] VCAT 1031);

- a lease to which the RLA applies at the lease commencement date can subsequently fall outside the ambit of the RLA during the lease term (eg. upon the tenant's occupancy costs exceeding $1 million). From the date on which the lease falls outside the RLA, the landlord is entitled to recover land tax from the tenant and enforce rent review ratchet provisions in the lease (Verraty Ptd Ltd v Richmond Football Club Ltd (Building and Property) [2019] VCAT 1073); and

- the circumstances in which the "ultimate consumer test" from IMCC Group Australia Pty Ltd v Cold Storage Pty Ltd [2017] VSCA 178 applies, included where there was a lease of a quarry at which the tenant carried on the business of extracting and selling sand, clay and gravel to its customers which customers used mostly for their own purposes, instead of the customers passing those materials on in an unaltered state (Phillips v Abel [2019] VCAT 1031).

To read about other recent Victoria retail leasing cases, see: Victorian landlords take note: the Retail Leases Act 2003 may apply to your lease

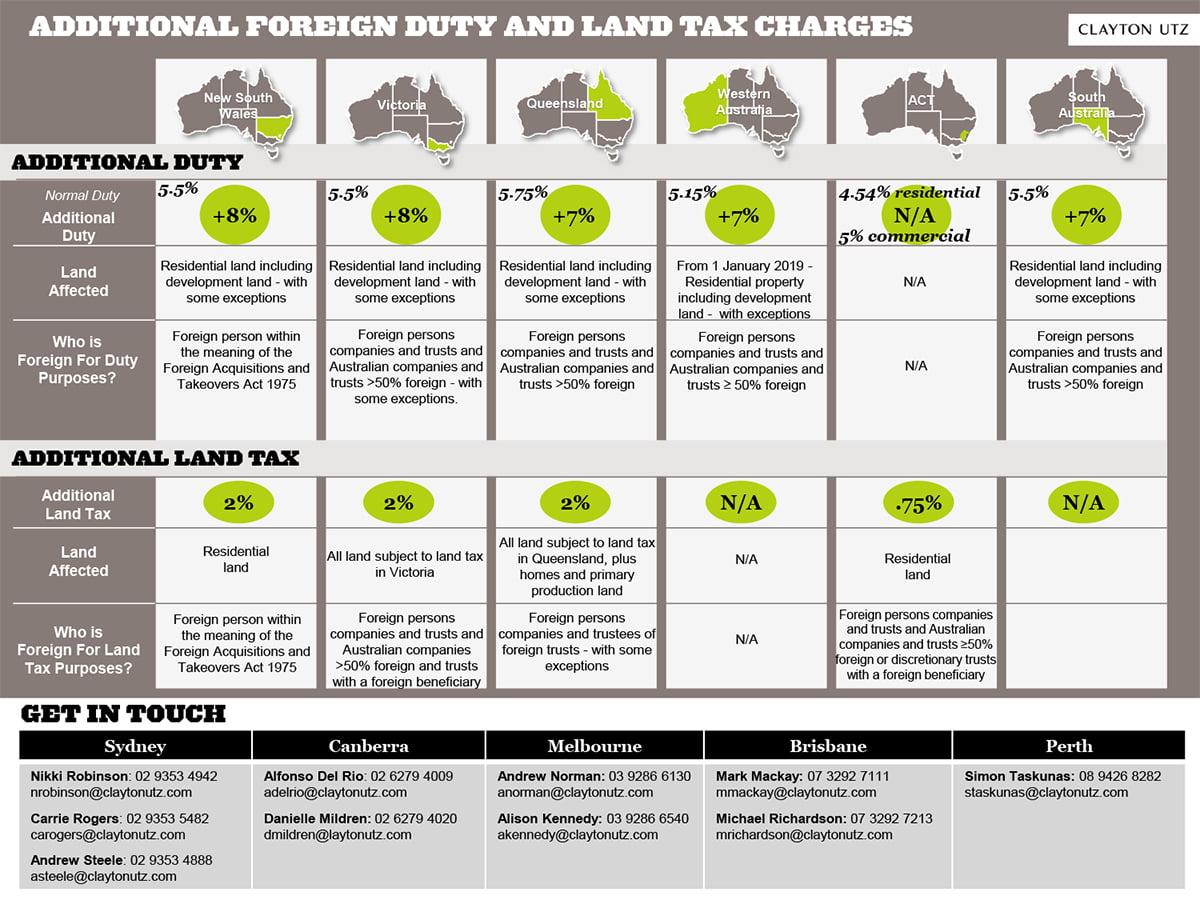

Victoria and Queensland: increased surcharges on foreign purchasers and landowners from 1 July 2019

As foreshadowed in our June 5 Minute Fix, the State Taxation Acts Amendment Act 2019 has now come into force resulting in an increase in the foreign purchaser stamp duty surcharge rate in Victoria from 7% to 8% for contracts entered into on or after 1 July 2019 (for residential land only).

The additional land tax applying to foreign owners in Victoria and Queensland has been increased to 2% to bring those States into line with New South Wales. These changes will apply to the current FY2020 land tax year for Queensland and the 2020 calendar year for Victoria. The additional 2% applies over and above the usual land tax rates.

ACT stamp duty changes

From 1 July 2019, the rate of duty payable for residential property (excluding concessions) has decreased, with the maximum now 4.54%. There has been no change to the duty rates for commercial property, where the maximum remains 5%. The reduction in stamp duty has been offset by increases in property rates.

Additional Foreign Duty and Land Tax Charges – national snapshot

Qld: New witnessing/VOI requirements to commence on 30 September 2019

From 30 September, anyone who witnesses the signature of an individual on a form to be lodged in the Land Titles Registry must:

- verify the identity of the individual;

- ensure that person is entitled to sign the document;

- retain a record of the steps taken to verify the identity of the individual and their entitlement to sign (or copies of documents obtained from the individual) for 7 years

This requirement applies to paper documents as well as PEXA lodgements and extends to witnessing the signature of an individual signing under a Power of Attorney.

Stay tuned for further details and practical tips for witnesses and signatories.

Get in touch