There's a new (Professional Standards) Scheme in town

The new Federal Chartered Accountants Australia and New Zealand Professional Standards Scheme came into force on 8 October 2019 and is substantially (but certainly not completely) the same as the previous State-based schemes. While members of the previous State-based schemes will be members of the Scheme, key changes will see holders of Australian Financial Services Licences also included as members.

Although the scheme we are focusing on for the purposes of this article is the chartered accountants' scheme, other professional service industries can participate in similar schemes, including solicitors, building consultants, engineers, computer professionals, surveyors and valuers.

If you are not already familiar with professional standards schemes, you may recognise the disclosure statement appearing in the footer of written communications from professionals covered by a scheme:

“Liability limited by a scheme approved under professional standards legislation”.

Professional standards schemes provide a mechanism for professionals to limit their liability where a scheme has been approved for that purpose and the professional has complied with the requirements to be covered by the scheme. The schemes are legal instruments which are also intended to improve the professional standards of their members and protect consumers of those professional services by requiring members to be insured up to the relevant monetary limit.

What's changed?

Prior to the Scheme taking effect on 8 October 2019, chartered accountants were covered by State-based schemes which were substantially similar and operated from 2014 to October 2019.

The key changes introduced by the Scheme (which has been approved for the maximum period of 5 years) are:

- the consolidation of the previous State-based schemes so that the Scheme applies in all Australian States and Territories. This serves to remove any ambiguity as to a territorial limitation upon the reach of the Scheme; and

- application of the Scheme to holders of Australian Financial Services Licences. Previously, the State-based schemes had limitations for members who held an Australian Financial Services Licence, or were authorised representatives of Australian Financial Services Licensees.

Otherwise, the Scheme is largely identical to the State-based schemes and continues to:

- cover the same categories of services:

- Category 1: Audit and Assurance Services;

- Category 2: Insolvency Services; and

- Category 3: Other Services; and

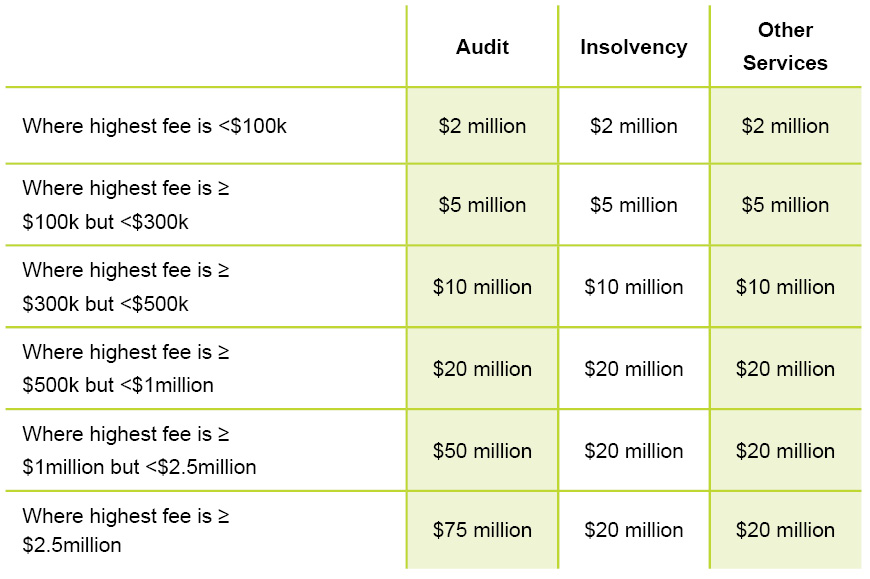

- provide the same limits of liability in respect of each of the above categories of services, which are set out in the below table:

In what circumstances will the Scheme not apply?

It is important to understand the reach of, and gaps in, the Scheme. This will be critical when a claim is made against an accountant for negligence or breach of duty as this will determine whether or not the liability of the accountant is capped by the Scheme.

Firstly, the Scheme only operates to limit liability where it has been raised by the accountant in defence of a claim. The accountant defendant must expressly and promptly plead reliance on the liability cap protections afforded by the Scheme as part of their defence to avoid the risk that a court may refuse to grant leave to the accountant to raise the defence. This was the outcome for the accountant in Centaur Litigation Limited (in liq) v Strong [2018] FCA 1715.

Secondly, the Scheme does not provide any protection to members who do not have:

- the benefit of an insurance policy which responds to the liability which is the subject of the claim;

- business assets with a net current market value of the relevant monetary ceiling; or

- a combination of a responsive insurance policy and business assets which meet the relevant monetary ceiling.

Relying on sufficient business assets to satisfy this requirement under the Scheme is a significant and unnecessary risk. Whilst an accountant may have a liability insurance policy which meets the relevant monetary ceiling, there is still a risk of the Scheme not applying if that policy does not respond to the particular liability which is the subject of the claim. This situation may arise in circumstances where the accountant does not select the appropriate insurance which covers all of the services the accountant provides. Where the particular liability is not covered by the policy, there is a significant risk that the liability caps under the Scheme will not apply.

This risk, as well as the risk of the liability policy not meeting the professional indemnity insurance requirements of the Scheme (being Regulation CR2A of CA ANZ's regulations), can be addressed by a comprehensive review of the relevant liability policies.

What to do now the Scheme is in force?

If you are a member of the Scheme, it is important to proactively review your liability insurance policies to ensure that they meet the requirements under the Scheme and will not be an impediment to enjoying capped liability provided by the Scheme.