Capitalising on Australia's offshore wind potential

Australia could be a world leader in offshore wind, with the regulatory framework being developed as one of the last missing pieces of the puzzle needed to harvest this Australian natural superpower.

A recent report from the Blue Economy Cooperative Research Centre, on Offshore Wind Energy in Australia finds that Australia has very high quality and abundant potential to develop a substantial offshore wind energy industry. This is a counterintuitive finding because it has been a common view in the industry that offshore wind energy is less attractive to the market than the perceived much cheaper and more easily available solar and onshore wind energy, especially in a country such as Australia with abundant land resources.

The research was partly funded by the maritime, electrical and manufacturing unions who all are calling on federal and state governments to take immediate steps and support the development of the offshore wind energy industry. The unions believe the development of the offshore wind farms has the potential to lead the transformation and create jobs for workers in traditional energy industries.

Experts predict that offshore wind will become one of the big three sources of renewable energy globally, alongside solar and onshore wind. Are they right? And what do they (and we) think are the obstacles and opportunities?

The technology

Offshore renewable energy includes offshore wind farms, wave and tidal power as well as emerging technologies like ocean thermal energy. The offshore wind energy industry is thriving globally as costs have fallen, the scale has grown and the development in technology including the size of turbines and the development of floating wind turbines has increased dramatically. That's why many developers in Australia are turning their eyes onto offshore wind.

This growing industry offers attractive career transition opportunities to oil and gas workers.

Other benefits of offshore wind include more reliable year-round generation capacity, fewer visual impacts on the landscape, reduction of risk associated with land dealings and attraction of significant investment in Australia’s coastal economies.

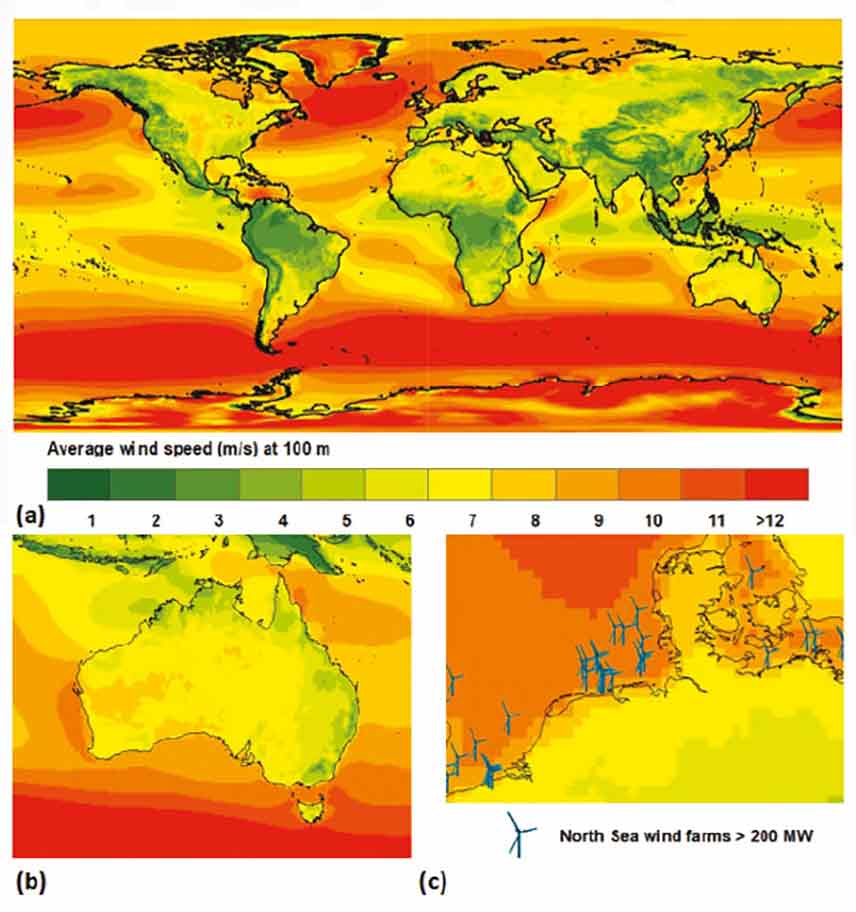

Figure 1: Mean wind speed (m/s) at 100 m level, derived from ERA-5 reanalysis, showing (a) global and (b) Australian wind distribution. Location of existing offshore wind farms with nameplate capacity > 200 MW in North Sea shown in (c). Source: Offshore Wind Energy in Australia, Final Project Report, July 2021, The Blue Economy Cooperative Research Centre (Report)

Global setting

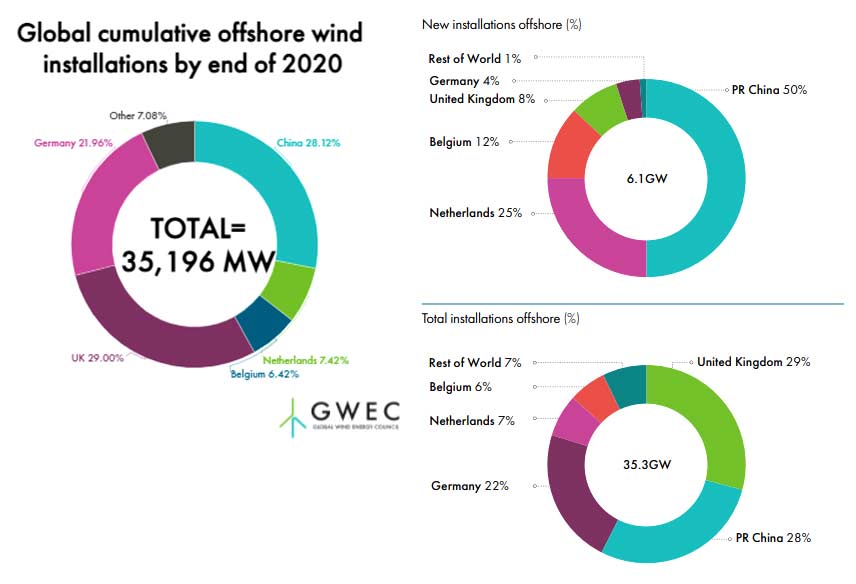

Currently global targets for offshore wind total around 200GW by 2030, including 30GW in the US.

The offshore wind industry, technology and regulatory framework are most advanced in the countries with limited capacity to develop renewable energy on land but with high potential of strong offshore winds ie. Europe with the lead of the UK, Germany, Netherlands, Belgium and Denmark and Asia-Pacific with China being in second place. The United States is falling behind the leaders but the Biden administration has recently set a goal of rapid growth with over 110GW of US offshore wind capacity by 2050.

Among other global developers Copenhagen Infrastructure Partners, with its dedicated expertise in energy infrastructure development and investments in North-Western Europe, North America and Asia Pacific, is a pioneer and a global leader in offshore wind bringing its expertise and methods to Australia.

Australia's current offshore renewable energy sector: a snapshot

Australia's current announced early-stage offshore wind projects have a combined capacity of 25GW.

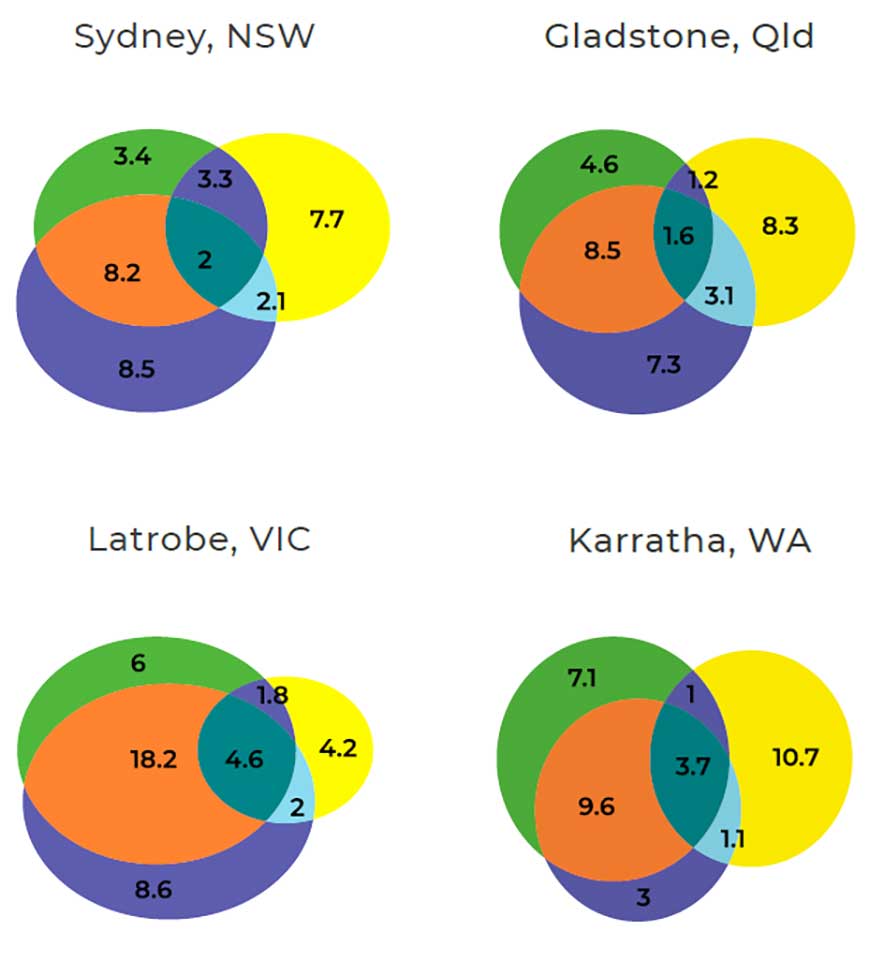

Figure 2: Potential offshore wind sites in Victoria, NSW, Qld and WA, the percentage of year during which offshore wind (purple), onshore wind (green) and solar PV (yellow) generation is operating at high capacity (>50%), and others operate at low (<25%) capacity. Where circles do not overlap this indicates the percentage of the year when one energy source is at high capacity while the others are at low capacity. For example, in Sydney, NSW, Offshore wind is operating at high capacity, with onshore wind and solar PV both operating at low capacity, for 8.5% of the year. Source: Report

Australia's most advanced offshore wind farm, the multi-billion dollar Star of the South project, planned for between 7km and 25km off the south coast of Gippsland intends to harvest the generous Bass Strait winds and take advantage of size and stability of the electricity grid in the LaTrobe Valley. This project is massive and has the potential to supply up to 20% of the State of Victoria’s electricity needs while also creating much needed jobs and investment. Clayton Utz is proud to be acting both as legal counsel to the project and its main investor, Copenhagen Infrastructure Partners (CIP), since 2017. This multi-disciplinary Clayton Utz team is led by Peter Staciwa and comprises partners Rory Moriarty, Andrew Leece, Damien Gardiner, Faith Taylor, Cilla Robinson, Pip Mitchell and Alison Kennedy.

Following Star of the South numerous other offshore wind projects have been announced around Australia.

Australia's future potential

The report found that there is over 2,000GW further capacity for offshore wind projects that could be installed within 100km of the Australian shore line. This includes new floating installations which will enable access to many of Australia's best offshore wind resources. The generation potential uncovered by the report is far more than Australia’s existing generation capacity and already excludes environmentally restricted and low-wind areas. Australian offshore wind resources have strong capacity factors due to consistency of wind and a significant proportion of the time that the generator can generate electricity, especially in the evenings.

Figure 3: Global market status of the offshore wind installations. Source: Global Wind Energy Council, Global Wind Report 2021

Importantly the report found that offshore wind farms are not intended to compete with, but rather will complement, the expanding design of Australia's renewables portfolio, particularly under “energy superpower” scenarios that anticipate mass electrification of many industries and in particular transport.

So what legally is hindering development of more offshore renewable energy?

At this stage, one of the main challenges necessary for an offshore wind industry to develop in Australia from the legal perspective is still an uncertain regulatory framework both at a Federal and State level.

At a Federal level the Commonwealth Government released the offshore clean energy infrastructure discussion paper for consultation in early 2020. Following public consultations and feedback from the industry, the legislative settings and framework are intended to be in place and operational later this year in the form of the Offshore Clean Energy Infrastructure Bill. This regulatory framework is intended to enable the exploration, construction, operation and decommissioning of offshore wind and other clean energy technologies and associated infrastructure in Commonwealth waters (beyond three nautical miles from the coast).

At a State level the Victorian Government has launched the Energy Innovation Fund with the first round focused on offshore-wind and are understood to be developing an offshore wind sector strategy.

Moving towards leadership in the offshore renewable energy sector

The report presents equally valid and counterintuitive arguments supported by a solid research that Australia has a huge potential to become a global leader in offshore renewable energy. Abundant natural conditions including favourable winds, access to shallow enough waters and emerging technology in floating wind turbines combined with falling costs present attractive opportunities for domestic and foreign investors. Global industry leaders like CIP are already taking action to utilise Australia's offshore wind power. The regulatory framework is one of the last missing piece in the puzzle and its prompt development should provide more clarity to the investors and hopefully increase interest in harvesting this Australian natural superpower.