Payment withholding requests and statutory charges: Upstream parties beware!

The Queensland Government’s latest instalment of its reform of the building industry puts new procedures in place to facilitate payment of outstanding adjudicated amounts. Queensland now joins New South Wales and Victoria in embracing a statutory payment withholding request mechanism.

The Special Joint Task, which investigated claims of subcontractor non-payment in the Queensland building industry, reported that securing payment of adjudicated amounts remains an obstacle for many subcontractors. Subcontractors will now be able to use payment withholding request to protect money payable as a result of an adjudication decision. Payment withholding requests are not restricted to projects requiring a trust account; any BIF adjudication claimant can use them to secure payment of an unpaid adjudicated amount.

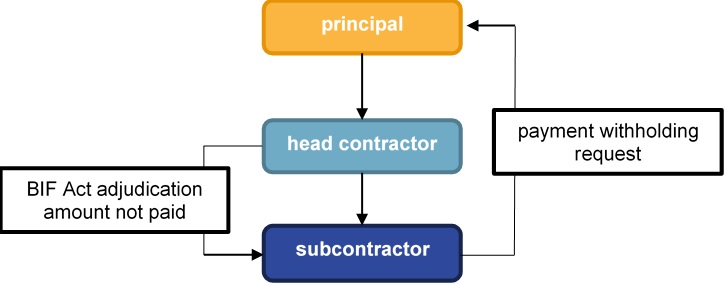

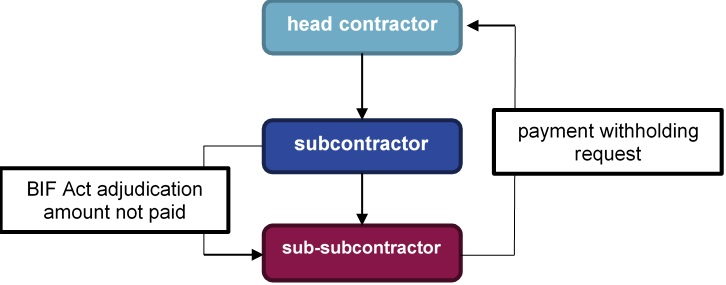

The mechanism facilitates the payment of outstanding adjudicated amounts. New measures allow a claimant to require a party higher in the contractual chain to withhold payment from the respondent, to secure payment of an adjudicated amount. A party that receives a payment withholding request must act quickly to withhold money (to the value of the adjudicated amount) to its contractor until the contractor has paid the outstanding adjudication amount. If the principal fails to withhold, it becomes jointly and severally liable with the contractor for the adjudicated amount owed to the claimant subcontractor.

It should come as no surprise that each jurisdiction takes a different approach as to when a payment withholding request can be issued. In Queensland, the payment request mechanism only applies where an adjudicated amount has not been paid within the timeframe required by the Building Industry Fairness (Security of Payment) Act 2017 (BIF Act). The NSW model is broader – all that is required is the making of an adjudication application. The narrower Queensland approach (similar to the Victorian model) avoids the risk to the cash flow of contractors arising from inflated payment claims from subcontractors, leading to adverse project outcomes.

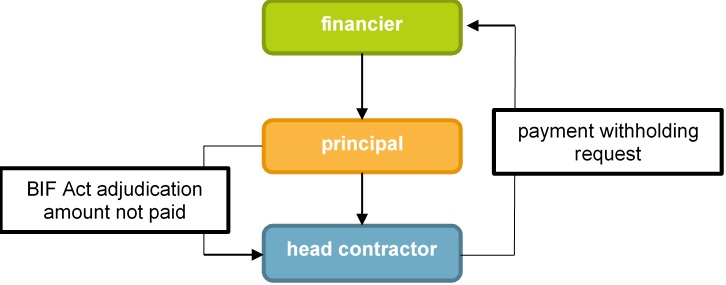

However, an important feature which differentiates Queensland's statutory scheme from southern states is a head contractor can place a withholding request over money that a financier of the project owes to a principal. In other models, the principal is the end of the line.

The following diagrams illustrate the different scenarios that may apply:

It remains to be seen whether head contractors will utilise the payment withholding request process. The effect of the legislation is to create a charge over the amount the subject of the payment withholding request. There may be other commercial factors at play, including potential financing events of default which could be triggered as a result of a head contractor giving a request to a project lender.

Charge over property

A blunter deterrent for failure to pay an adjudicated amount is a head contractor's right to lodge a statutory charge over the project property. A head contractor may register a charge against project property owned by the respondent (ie. the principal) or a related entity of the respondent.

The charge will stand behind other secured interests (for example mortgages) registered earlier than the charge. However, the implications for lenders are significant. The head contractor may initiate the sale of the property, applying for a court order that the property be sold to satisfy the respondent’s debt to the claimant. Although secured lenders retain their property interest, the loss of control over the timing of the sale of the land may be of concern.

It’s a case of wait and see as to whether the charge over property provides additional benefits over and above existing enforcement mechanisms. Practical implications to consider:

- for the land owner, the noting of the charge on the property may prompt a mortgagee to scrutinise its customer's financial position and, in some cases, constitute a mortgage default;

- for the head contractor, success in recovery from proceeds of sale will depend upon the level of equity in the property – there may be little or nothing left over for the claimant to be paid after secured lenders receive payment of their outstanding debt.

What next?

These amendments will not commence until a future date, which has not yet been proclaimed. We'll keep you posted.

Get in touch